HSNW Company HotlistViolin Memory: Winning over the intelligence community

Violin Memory (NSYE: VMEM) is a recently IPO’d enterprise flash memory provider that has won installations across the most demanding branches of government, particularly in intelligence and homeland security. One advantage the company holds is a partnership with Toshiba, the world’s #2 manufacturer of NAND, which reportedly gives Violin insider-access to the unpublished R&D data, allowing for a product that has steadily performed steps ahead of the competition. The partnership also allows Violin to buy NAND at special “producer-like” prices from Toshiba, which in turn has enabled Violin to price more competitively, up to 50 percent lower than other providers. What is clear is that Violin’s technology adoption is growing exponentially within the security sector and other areas where data performance cannot be compromised and is mission critical.

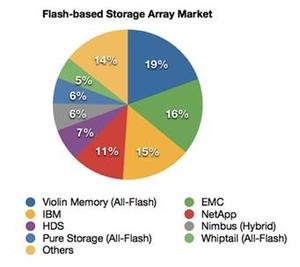

Violin Memory leads the field in the deployment of flash array vendor implementation // Source: 451 Research

Violin Memory (NSYE: VMEM) offers a new class of flash-based systems — hardware and software — designed to bring storage performance in line with high-speed networking and big data computing trends. Almost 50 percent of enterprise workloads are now virtualized and moving to the cloud, and in turn the focus is shifting from storage capacity to I/O capacity. And this need for high-frequency, anywhere, real-time access to data is growing at an explosive rate of 66 percent CAGR from now until 2017 (source: Cisco VNI 2013). As data traffic has exploded, traditional hard-disk storage approaches simply cannot keep-up, stifling efficiency and throughput.

Companies are actively seeking solutions to this major IT transformation, and Violin Memory’s arrays are increasingly being installed by the most tech-savvy customers, branches of government, and the Fortune 100 such Walmart, Verizon, JP MorganChase, and a growing number of others. Violin’s technology appears to be particularly well-suited to the intelligence community, meeting the need for processing massive data sets as close to real-time as possible. CompSec, one of the largest resellers of complex technology to the intelligence community, now lists Violin Memory on their vendor page, and according to our sources has become of the company’s top customers.

Gartner Research recently published report on the flash-storage market ranked Violin Memory #1 for enterprise flash. Another leading storage industry research group, 451 Research, conducted a survey on flash vendor implementation showing that Violin Memory is clearly leading the pack as the market begins to test out the use of flash.

Based on the research, which shows that while the flash market is still nascent, enterprise flash memory has clearly come of age, Violin is the clear leader among the companies being fielded, for “In-pilot/ Evaluation” as well as full-scale ‘Implementations’. The market breaks down as follows according to Chris Mellor at the Register:

“The top four are Violin and EMC, followed by Cisco/Whiptail, with IBM/TMS in fourth place. Solidfire, NetApp, HDS and Dell follow in descending order.”

“The top four look poised for much greater success than everybody else. Pure Storage, and suppliers similarly ranked, have a mountain to climb if they are actually going to compete with the flash array leaders.”

Violin Memory’s CEO is Don Basile, a Ph.D. from Stanford University and former IBM researcher who has been a pioneering force and adviser to the public and private security/storage sector for the last decade. Prior to Violin Memory, Basile was the CEO of Fusion-IO (NYSE: FIO), a billion-dollar company that provides flash PCIe cards to customers such as Apple, HP, and Facebook. In interviews, Basile has stated that Violin’s Flash “Arrays” are a technology leap-frog over what he had earlier developed at Fusion-IO, with generation advantages including absolute performance, hot swap-ability, full interoperability, and cost scalability.

Regulatory filings show that Toshiba is a significant equity owner of Violin Memory, and this partnership company’s unique advantage has translated into Violin’s ability to outperform all competitors across seven major performance metrics. More can be read on Violin’s partnership with Toshiba (see Gartner report here). Violin Memory’s own white paper on technology for Federal Government Agencies describes the performance capabilities and cost-savings of their technology.

HSNW will continue to offer analysis and follow Violin Memory as well as other trending companies in the security and intelligence sectors.

This analysis of Violin Memory is part of a new HSNW series focusing on homeland security-relevant companies.