Europe's first finger-vein biometric ATMs installed in Poland

Poland claims to be the first European country to install finger-vein biometric ATMs; the authentication system developed by Japanese tech giant Hitachi; unlike fingerprints, which leave a trace and can be potentially reproduced, finger veins are impossible to replicate because they are beneath the surface of the skin

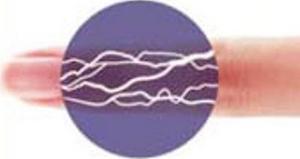

Finger veins follow unique, identifiable pathways // Source: blogspot.com

Poland’s cooperative BPS bank says it is the first in Europe to install a biometric ATM — allowing customers to withdraw cash simply with the touch of a fingertip.

The digit-scanning ATM, introduced in the Polish capital of Warsaw, runs on the latest in finger vein technology, an authentication system developed by Japanese tech giant Hitachi (see “Finger-vein biometrics on the rise,” 5 February 2008 HSNW; and “Sagem Sécurité, Hitachi combine fingerprint and vein recognition technologies,” 25 March 2009 HSNW).

CNN’s George Webster reports that the company says that an infrared light is passed through the finger to detect a unique pattern of micro-veins beneath the surface — which is then matched with a preregistered profile to verify an individual’s identity.

“This is a substantially more reliable technique than using fingerprints,” Peter Jones, Hitachi’s head of security and solutions in Europe, told CNN. “Our tests indicate there is a one in a million false acceptance rate — that’s as good as iris scanning, which is generally regarded as the most secure method.”

Unlike fingerprints, which leave a trace and can be potentially reproduced, finger veins are impossible to replicate, according to Jones, because they are beneath the surface of the skin. “And before you ask, no — it doesn’t work with fingers that have been chopped off,” he added.

While the technology represents a step forward in reducing cases of identity fraud, Jones said that this is just one of many factors that have encouraged the Polish bank to adopt it. “Here, banks have a responsibility to perform various social functions like dispensing welfare checks and pensions. These cause long queues at the cashier and many people find it inconvenient and even debilitating.”

Webster quotes Jones, who has worked with the bank for over three years, to say that BPS plans to install a biometric ATM at every one of its branches by the end of the year, where they will also function as a collection terminal for state benefits.

Webster notes that although it is a first for Europe, biometric cash points have been embraced in other parts of the world for some years. According to business data analysts Bloomberg, the technology became particularly popular in Japan after the passing of legislation in 2006 that made banks liable for withdrawals by criminals using stolen or counterfeit bank cards.

Jones says that there are now over 80,000 biometric ATMs in Japan, currently used by more than